Working in the healthcare sector, especially for physicians, is often financially lucrative as it involves significant contributions to saving and improving lives. However, high-income medical professionals face considerable financial challenges, primarily stemming from substantial tax liabilities accrued throughout the year. Coupled with the repayment of sizable educational debts, these financial obligations can pose significant constraints on their budgets.

The encouraging news is that despite being in a high tax bracket, there are strategic approaches available to alleviate these financial pressures. In the following sections, we will delve into various “tax planning” tips designed to assist physicians and other high-income medical professionals in preserving a more substantial portion of their earnings for future financial stability.

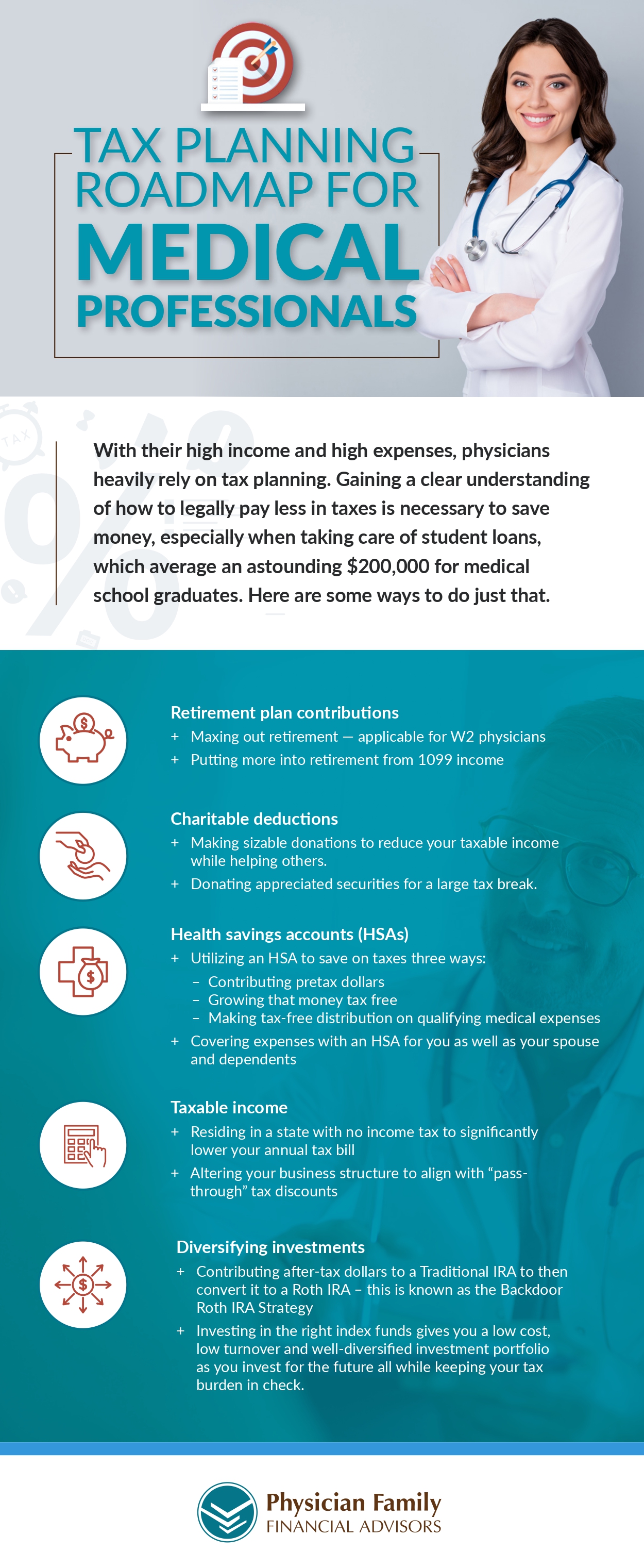

Tax Planning Roadmap for Medical Professionals from Physician Family Financial Advisors, a provider of financial planning services for physicians